BlockFi Review

In the world of cryptocurrencies, there is certainly no shortage of options for buying, selling, and storing digital assets. What is a bit lacking are services aimed at offering crypto investors with options similar to what investors have always found with traditional financial institutions.

The ability to store digital assets while earning compounding interest, or leveraging digital holdings as collateral, are two examples of services that today’s crypto investors have begun to expect. And, that is precisely where BlockFi comes in.

Who Is BlockFi?

BlockFi is a company that seeks to bridge the gap between the traditional and the contemporary.

BlockFi maintains a crypto-centric focus but offers many unique options to its customers. BlockFi

customers can trade, hold, or even become their own bank, through services offered at BlockFi.

BlockFi got its start in 2017. Back then, it was the only company of its kind offering what it did to its customers. It is no longer the only place to get crypto-secured fiat loans, and it certainly isn’t the only option for those looking to earn interest on their crypto savings. However, BlockFi is still one of the most trusted names in the space and they keep adding new features all the time.

Why Use BlockFi?

If you are still wondering why you might want to use BlockFi’s services, here are a couple of

reasons.

BlockFi provides a platform where crypto investors can easily participate in the cryptocurrency marketplace. Users can do everything relating to their digital asset investments from one app or webpage. Buying and selling assets is possible, trading between crypto pairs, and interacting with a traditional bank account through Plaid makes the entire process very simple.

What’s more is that while funds are held by BlockFi, the company pays competitive interest rates on those holdings. Add in the ability to take out cheap loans that are backed by assets in the user account and you have a platform that offers a very interesting set of advantages.

BlockFi Credit Card

One exciting new feature is the BlockFi credit card. The card is a first in many ways.

BlockFi has partnered with Visa to offer a (metal) card that that is accepted everywhere Visa is. Among the host of benefits that the company has attached to the card are Bitcoin rewards, enhanced bonus programs, an upgrading referral program, and additional APY interest paid on savings.

The card can essentially provide users with a steady flow of passive Bitcoin savings, and all they have to do is use the card to pay for their everyday expenses.

Unsurprisingly, a card like this that touts so many benefits will not come for free. There is an annual fee for the card that sits at around $200 per year. Whether the benefits outweigh the cost of membership will depend on a user’s spending habits. For many, it could very well provide plenty of value.

BlockFi Asset Selection

The asset selection at BlockFi is not as diverse as one might expect. While the available assets have expanded over time, you will find much more expansive selection on other platforms.

BlockFi does feature many of the more popular choices, however. So, the somewhat limited selection may be perfectly fine for many. In short, the selection includes a few of the most popular cryptocurrencies and several stable coins.

Coins available are as follows:

· LINK

· LTC

· ETH

· BTC

· PAX

· PAXG

· BUSD

· USDC

· USDT

· GUSD

BlockFi’s Savings Accounts

Of all Blockfi’s services, the savings accounts are one of the most notable. The APY rates are high and it is possible to earn upwards of 10% APY on invested funds.

Because of this, many of the BlockFi’s customers use the services for long term digital asset portfolio building, as opposed to short term trading strategies.

Interest is paid monthly and compounds over the course of the year.

Flexible Interest Options

An aspect of BlockFi’s interest program that many find useful is the flexible nature of the interest payouts.

For example, if a user is holding BTC in an interest-bearing account, a choice can be made about how the interest in paid out. It can either be paid into the interest account that generated the interest payment, or it can be diverted into another interest account, such as a stablecoin account.

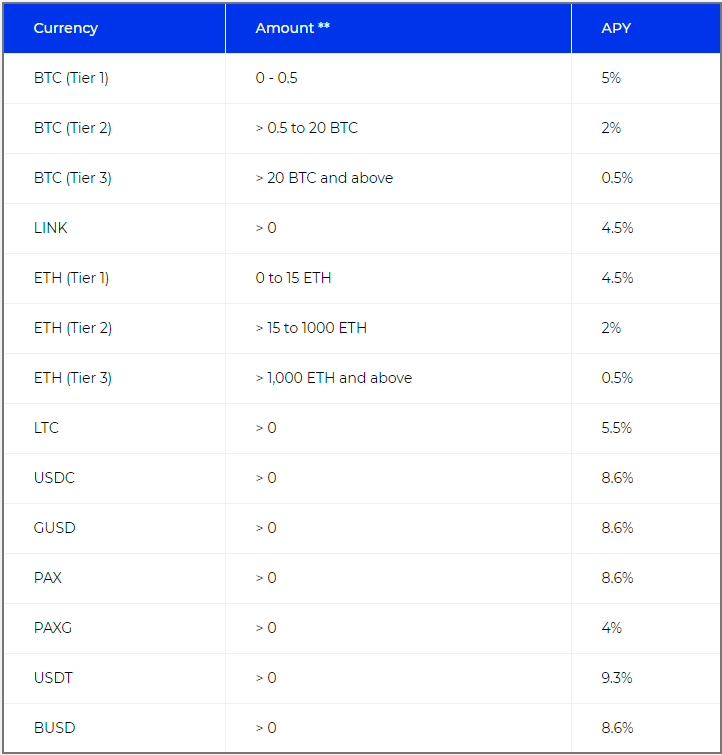

Interest Rates Per Asset

If you are considering a BlockFi interest account for your long term digital asset savings, it may be useful to know that not all assets accrue the same amount of interest.

Stablecoins bring in the highest APY, ranging from 8.6% to 10%. ETH and BTC bring in 4.5% and 5% respectively.

Another thing that is important to keep in mind while making a decision about where to park your digital assets is that BlockFi uses a tiered interest program. Basically, as holdings in either ETH or BTC reach certain thresholds, the APY rates drop.

For bitcoin, there is an APY of 5% for holdings equal to or less than half a bitcoin. From 0.5 BTC to 20 brings the APY down to 2%, and above 20 BTC sees an APY of 0.5%

Similarly, Ethereum starts out at 4.5% for holdings equal to or less than 15 coins. Then, drops to 2% for accounts with 15 to 1000 coins. Finally, any ETH interest accounts with more than 1000 coins will see an APY of 0.5%

BlockFi’s Crypto-Backed Loans

In addition to the high APY interest rates offered on digital asset saving accounts, crypto-backed loans have been a big part of BlockFi’s success in the crypto space.

BlockFi offers loans to its customers that go as high as 50% of the borrows digital asset account value.

This means that when investors need to leverage their crypto holdings to either make a large purchase or even to buy more crypto, they do not have to sell their stack to get the funds they need.

Instead, borrowers can use the low-cost loans that BlockFi provides. When the loan is paid back, the digital assets return to the user’s account.

Getting a BlockFi Loan

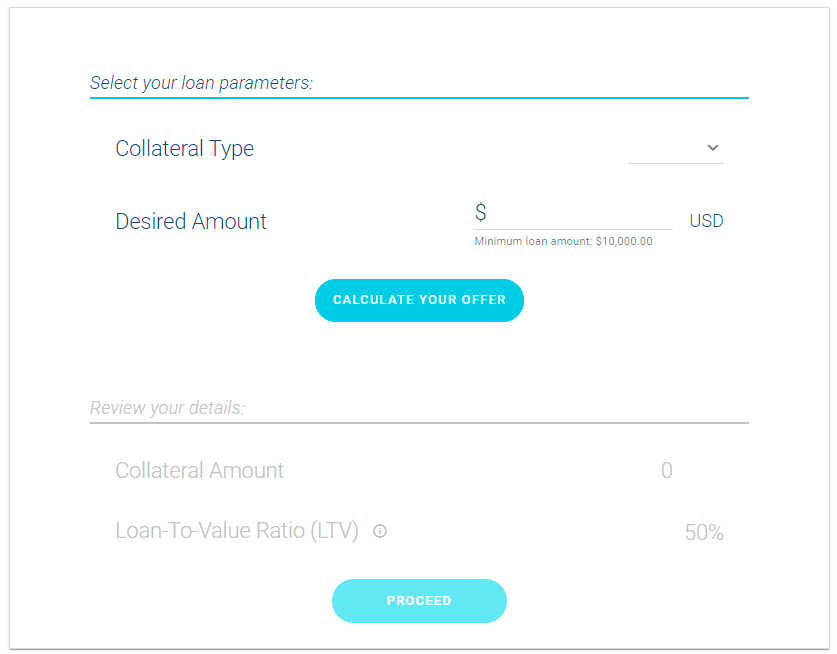

Getting a BlockFi loan is surprisingly simple and only takes a few minutes to apply. The main thing to remember is that the loan amount requested can be up to 50% of the total value of the assets in the account.

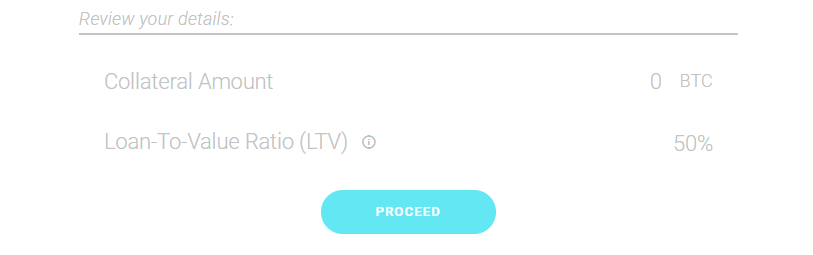

Using the loan calculator on BlockFi’s system, a user can easily decide on the parameters of the loan amount and collateral.

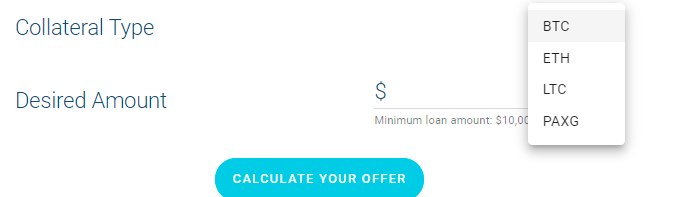

The first step to choose the digital asset that is to be used as collateral. Options include BTC, ETH, LTC, and PAXG.

Next, the amount of the loan must be chosen. Please note that loan requests under $10,000 will not be accepted.

Once a user selects the digital asset and the loan amount, the loan calculator provides a collateral amount based on the information given. The Loan-To-value Ratio (LTV) is set to 50% and that is how the collateral is determined.

Immediately following the calculation stage, borrowers sign the loan agreement and wait for a response from BlockFi’s loan team. Loans are generally granted with 1 or 2 days.

BlockFi Review Final Thoughts

BlockFi provides users with many options to buy, sell, and grow their crypto assets. Through the interest accounts that pay out interest on a monthly basis and the user-friendly trading platform, investors can easily take part in the world of cryptocurrencies. Add to that the BTC rewards card from Visa and the fact that investors can become their own banks by using their own funds to take out loans and you have a one-stop-shop that novice to advanced crypto users could certainly enjoy.

|